Quick Summary

⏱️ Compressed Sequences: Black Friday email sequences are highly compressed, averaging 3.01 emails over 5 days, making clarity and purpose in each message essential.

📊 Main Sale Dominance: Main Sale emails dominate with 76.40% of sends, while Teasers (14.45%), Reminders (6.13%), and Last-Chance (3.54%) play supporting roles that lift total revenue.

🎙️ Evolving Tone: Tone shifts measurably across the sequence, moving from neutral to positive, seen in brands shifting from “Black Friday is almost here” to offer-led lines like “Don’t miss 40% off!”

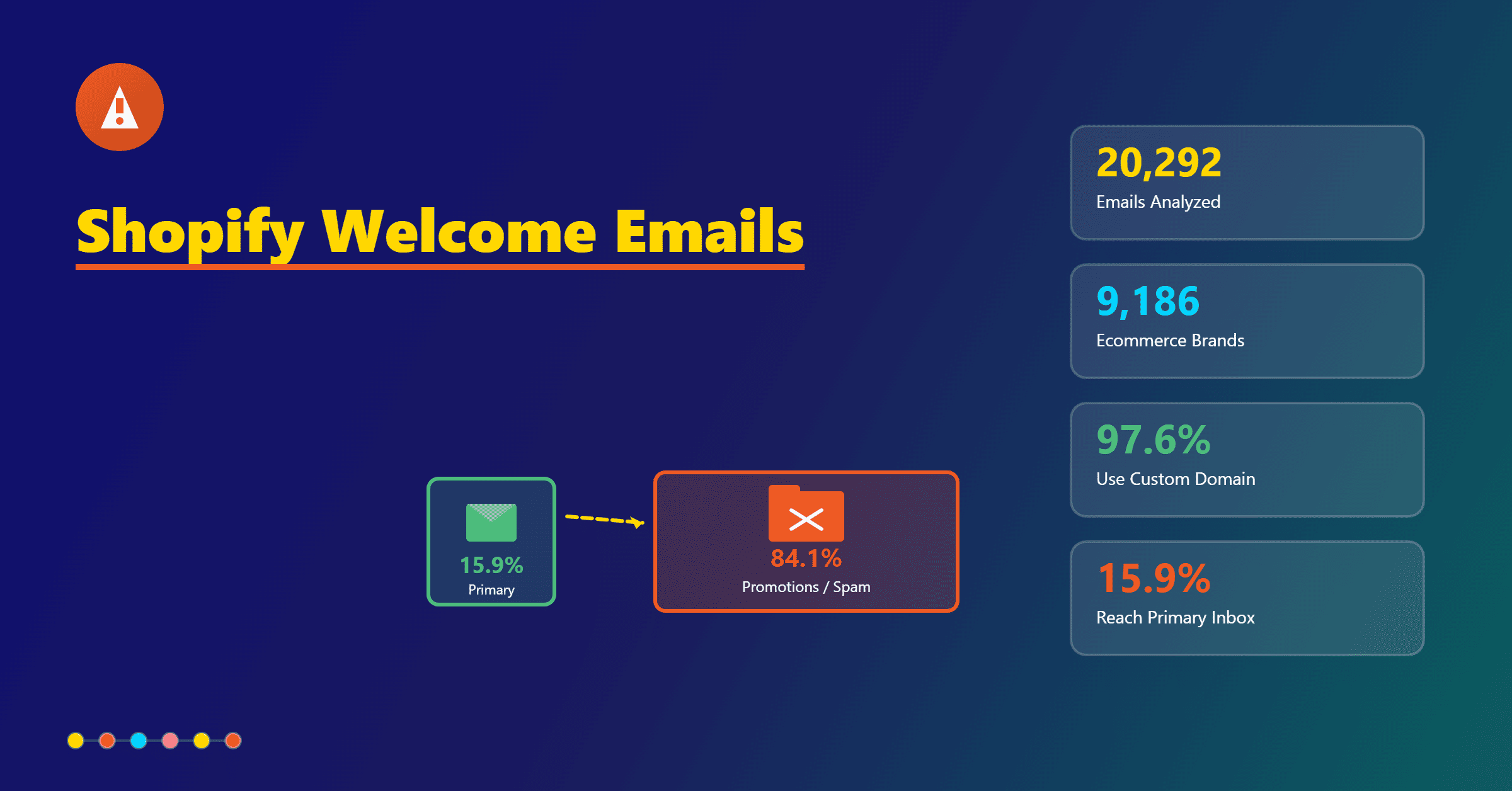

📨 Promotions Tab Reality: Promotions tab placement is the norm, with Teasers landing 84.29% in Promotions and Main Sale emails 91.92%, reinforcing that clarity, not inbox placement, is what drives conversions.

🔁 Post-Black Friday Re-engagement: The post-Black Friday window activates quickly, with follow-ups sent an average of 1.81 days after Black Friday, and 18.22% using reactivation language to convert late shoppers.

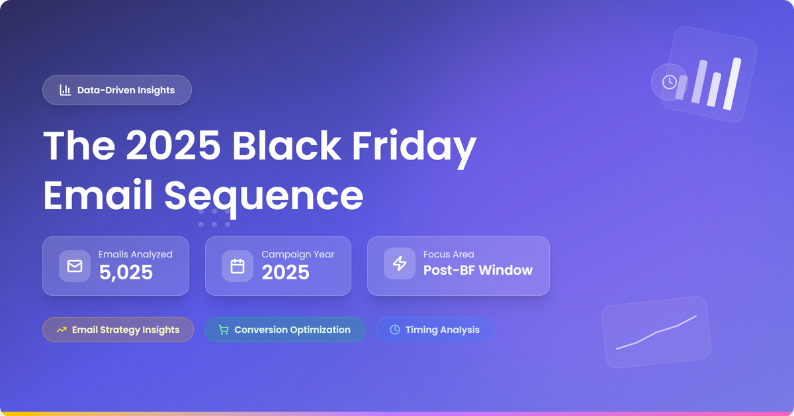

To understand how eCommerce teams actually execute across Black Friday and the days that follow, we examined 5,025 emails from 1,404 brands over 399 days.

Within that, we zoomed into the 2024 season specifically, covering 3,275 Black Friday emails across 881 unique brands and 461 post‑Black Friday sends. This view shows both macro patterns and what changed in the latest cycle.

The headline is efficiency. The average brand sent 3.01 emails per Black Friday Email Sequence over about five days.

That compression matters. When you think strategy, think agility: fewer messages, tighter windows, clearer phase intent.

Anatomy of a High‑Performing Black Friday Email Sequence

How Long and How Fast: 3.01 Emails Across 5 Days

Three emails may feel light, but that was the norm. Brands, on average, packed a sequence into five days, signaling that pacing, not volume, wins.

The cadence tends to map to an early signal, a strong core run, and a clean finish. Over‑sending rarely improves performance once the offer is live, especially when you’re already competing in a Promotions-heavy inbox environment.

In practical terms, that means the first touch should establish relevance, the middle should do the heavy lifting with value clarity and social proof, and the final touch should resolve hesitations and create closure.

With only three opportunities on the board, each email needs a distinct job.

Phase Mix That Actually Drives Revenue: 76.4% Main Sale Dominance

Phases were not evenly weighted. Teasers represented 14.45% of emails, Reminders 6.13%, Last‑Chance 3.54%, and Main Sale a commanding 76.40%.

The implication is clear: brands allocate most of their real estate to the core shopping window. That is rational behavior because once the sale starts, the goal is to capture intent while attention is highest.

Still, the outliers matter. Teasers preview inventory or savings to prime demand and lift open rates when the sale hits. Reminders help re‑enter the conversation without cannibalizing the final push.

Last‑Chance messages are deliberately sparse, but they often deliver outsized urgency to a small but convertible segment.

If your mix is 100% Main Sale, you’re probably leaving money and engagement behind, especially with VIP and price-sensitive segments.

More Black Friday Email Marketing Resources for You

Tone That Turns Browsers into Buyers

Across sequences, the subject line tone moved from neutral to slightly more positive from the first to the last email.

Brands like 1A Auto made this shift visible, evolving from cautious primers such as “Black Friday is almost here” to energetic, offer-led subject lines like “Don’t miss 40% off!”

This matters because shoppers escalate their readiness as the event unfolds; tone should match that momentum.

Neutral openers tend to preview without committing to numbers. By the mid-sequence, percentage-off clarity and product cues outperform coyness.

The final message can carry urgency, but staying constructive and benefit-focused prevents fatigue. Think invitation, not alarm bell.

Deliverability Patterns You Can Work With

Folder placement followed a predictable pattern across phases, and it should shape expectations more than change your strategy.

Teasers landed in Promotions 84.29% of the time, with 2.57% in Primary and 13.14% in Spam. Reminders skewed even more to Promotions at 92.86%, with a small Primary presence and 6.17% to Spam.

Last‑Chance emails were almost entirely Promotions at 99.44%, with no measurable Spam. Main Sale remained Promotions-heavy at 91.92%, with 1.43% Primary and 6.64% Spam.

In other words, plan for Promotions, optimize for clarity, and win on content. Readers in Promotions are scanning with shopping intent during this period.

Subject lines that announce the value quickly, preheaders that confirm it, and hero sections that deliver a crisp why-now will outperform attempts to chase the Primary tab. Your biggest lever is phase-relevant messaging, not folder gymnastics.

The Critical 48 Hours: Post Black Friday Email Campaigns That Convert

The post‑BF period is no longer an afterthought. Brands moved swiftly, with follow-ups going out an average of 1.81 days after Black Friday, effectively pivoting into Cyber Monday or extended sale framing within roughly 48 hours.

We tracked 461 such messages, and every single one was categorized to Promotions, with no Primary or Spam placement. If your strategy hinges on a Primary inbox miracle, you’re swimming upstream. Win the Promotions tab with clarity and timing.

Reactivation language showed up in 18.22% of post‑Black Friday email campaigns. Phrases like “Missed out?,” “Still time,” and “Cyber Week extended” reset the offer narrative for late deciders.

Meanwhile, 24.13% of brands—209 in total—formally extended Black Friday into Cyber Monday or beyond. This continuation gives you permission to bring back people who ignored, postponed, or opened but didn’t click during the core window.

The strategic split leaned toward reactivation at 18.22% versus a 4.56% retention focus. That makes sense in a high-acquisition week, but it shows an opportunity.

Your best customers are primed for add-on purchases, upgrades, or bundles post‑event. A simple segmentation layer can maintain reactivation momentum while rewarding loyalty with differentiated perks, exclusive SKUs, or early access to Cyber Week sets.

Reactivation vs. Retention: Smart Use Cases for Each

Reactivation excels when it reframes the outcome. If the Black Friday narrative was about biggest-ever prices, the post‑BF message can stress that there is still value and still time, with availability or low-stock proof points.

This is not a rerun; it’s a second chance with different stakes. Lean into updated copy that reflects a new angle rather than duplicating the Main Sale email.

Retention thrives when it connects purchase context to next-step value. Recommend complementary products, showcase verified reviews on the item they considered, or offer loyalty points acceleration for a limited Cyber Week window.

Even a modest points boost can outperform a deeper last-minute discount because it signals appreciation, not liquidation.

Subject Lines and Offers That Fit the Post‑BF Moment

Tone should remain positive and specific. Subject lines that acknowledge the moment without sounding remorseful perform better. The difference between “Last chance, again” and “Cyber Week extended: Final 24 hours on bundles” is respect for the reader’s time. Clarity wins the scan.

Offer structure should evolve, too. If percentage-off drove Black Friday, bundle value or threshold gifts can drive Monday–Wednesday.

Device and channel-targeted messaging, such as SMS nudges to cart abandoners who opened but didn’t click, keeps the journey moving without spamming the inbox.

A Blueprint You Can Lift for 2025

Start by designing a compact Black Friday Email Sequence of three to four messages across five days.

Allocate most messages to the Main Sale while preserving one clear Teaser and a concise Last‑Chance. Your Teaser should preview savings or categories with social proof cues to warm the list. Your Main Sale messages should lead with the number, remove friction with free shipping or returns cues, and showcase top-converting products.

Your final send should close loops: highlight sellouts, warn of expiring perks, and reaffirm the strongest reasons to act.

Plan your post‑BF pivot before Friday goes live. Set time-based triggers that schedule your first post‑BF message roughly 36 to 48 hours later.

For those who clicked but didn’t buy, use reactivation language and bring forward best-sellers still in stock. For buyers, offer value-adds rather than deeper discounting—think loyalty points multipliers, limited accessories, or early access to holiday drops.

Because placement will sit in Promotions, ensure your email renders crisp on mobile, with an offer statement in the first viewport and a tap-friendly call to action.

Match your tone to the clock. Early sequence copy can be informative and brand-forward. From the moment the sale starts, shift to energetic and specific, just like the brands that moved from “Black Friday is almost here” to “Don’t miss 40% off!”

As the event closes, keep urgency honest and benefits front and center. Shoppers are immune to generic countdowns; they respond to concrete loss aversion such as expiring bundles, limited sizes, or shipping cutoffs.

More Black Friday Email Marketing Resources for You

Measurement and Iteration That Actually Improves Outcomes

Given Promotions-dominant placement, quality-of-engagement metrics become the truest signal.

Track read time and click‑to‑open rate to judge message clarity. Map phase attribution so you understand whether your Teaser is warming interest or just pulling opens.

Watch conversion deltas between midsequence messages; if Main Sale B underperforms, diagnose whether offer clarity, product mix, or timing missed the mark.

Use microsegmentation without overfitting. A simple bifurcation between open‑no‑click and click‑no‑purchase groups can meaningfully increase your post‑BF performance.

The first group needs sharper value framing; the second needs confidence and convenience: reviews, guarantees, shipping certainty.

Layer loyalty and purchase history to deliver the smallest possible discount to the segment most likely to respond to non‑price incentives.

Why This Matters for Your Tech Stack

Executing all of this requires orchestration, not just sending. A platform like TargetBay Email & SMS helps you map phases, schedule the compressed cadence, and let an AI email agent propose on‑brand variants that track the tone shift from neutral to positive through the sequence.

When your post‑Black Friday sends need quick pivots, dynamic segments and triggered flows matter more than ever.

Your conversion proof points deserve equal attention. TargetBay Reviews can inject recent, high-intent social proof into Main Sale and extended‑sale messages, including photo and video reviews that lift click confidence.

If your post‑BF strategy includes rewarding best customers, TargetBay Rewards lets you run points accelerators or members‑only perks without engineering lift, giving retention the attention it deserves during a high‑acquisition week.

Closing Thoughts

The data shows a tight Black Friday Email Sequence works: three emails, five days, with Main Sale carrying most of the weight and a tone that gets more upbeat as the offer peaks.

Promotions-tab placement is a feature, not a bug, so focus on phase clarity, timing, and message specificity. In the 48 hours after Black Friday, move quickly with post‑Black Friday email campaigns that re‑activate late deciders and reward recent buyers without eroding margin.

Brands that plan the pivot, respect the reader’s time, and evolve the offer structure win the week and set up December.

Unifying campaign orchestration, social proof, and loyalty under one roof makes this playbook easier to run.

If you want fewer moving parts and more predictable outcomes, tools like TargetBay Email & SMS, TargetBay Reviews, and TargetBay Rewards keep every phase aligned and every message on mission.