⭐ Quick Summary

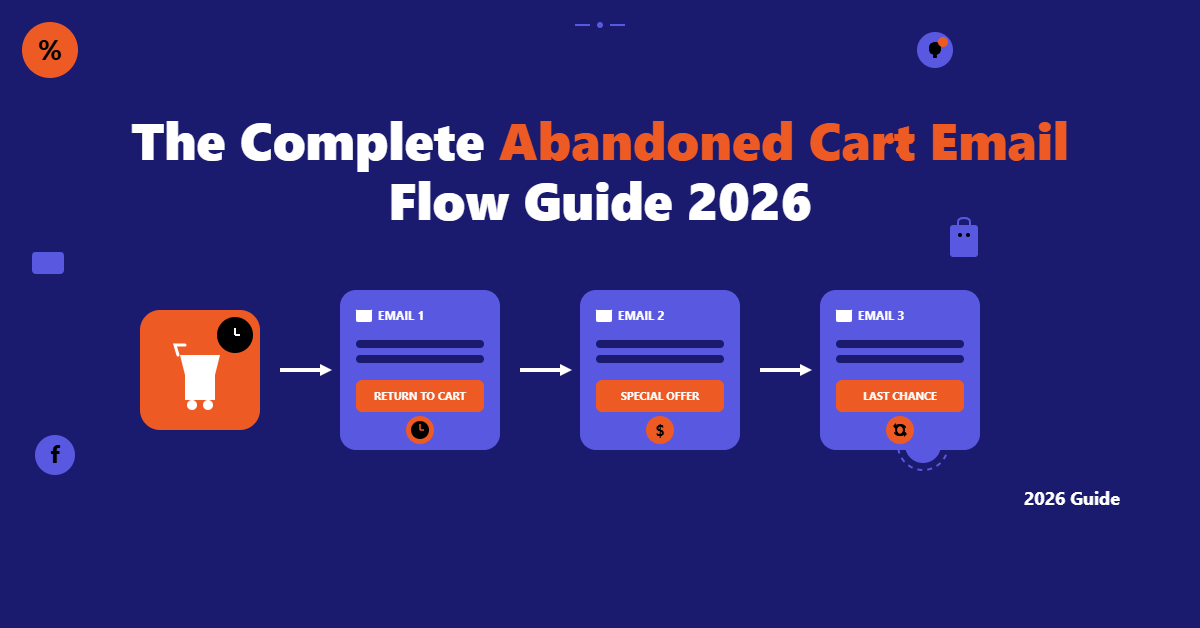

🧩 Most brands keep it short: Among 497 brands and 756 flows, the average abandoned-cart sequence is 1.52 emails, confirming that 1–3 messages is the standard baseline.

⏱️ Timing beats volume: Performance peaks with 18 hours between Emails 1–2, ~1 day between Emails 2–3, and sending in the 6–9 PM window (peak 7 PM).

📉 Deliverability drops with depth: Inbox placement declines from 46 → 28 → 15 across Emails 1–3, making early-message quality essential and later-message expansion data-dependent.

🎁 Offers work, but placement matters: Although 90.67% of brands include an offer in Email 1, moving smaller incentives to Email 2 and stronger ones to Email 3 avoids training discount-first behavior.

👉 CTA clarity peaks in Email 3: CTA usage rises to 15% in Email 3 versus ~11% in earlier messages, making Email 3 the best place for a single, decisive call to action.

If you’ve ever wondered how many abandoned cart emails I should send without tripping spam filters or training shoppers to wait for discounts, you’re not alone.

Most e-commerce teams don’t have the time or volume to A/B test every variable in an abandoned cart drip sequence.

This guide distills real-world practice from 756 emails across 497 brands into practical recommendations you can use today.

Snapshot of current practice

Across 497 brands and 756 emails, the average number of emails per abandoned cart email flow is 1.52. That single figure hides a wide spread.

A clear majority, 334 brands, rely on a single follow-up. Another 103 brands run two-message sequences, and 39 brands go to three.

Only a small minority push beyond that, with 12 brands at four messages, five brands at five messages, and just two brands each at six and seven messages.

The implication is straightforward. Despite the abundance of generic advice recommending long drips, most teams stick to one to three emails.

This aligns with deliverability patterns, where deeper messages have lower inbox placement and higher spam risk. It also reflects practical resource constraints.

Writing, designing, and maintaining seven distinct messages with dynamic content and compliant logic is rarely feasible for lean teams.

If you’re building or auditing an abandoned cart drip sequence, treat one to three emails as a baseline and add length only when your industry and sales cycle consistently warrant it.

Abandoned Cart Email Playbook

Turn abandoned carts into revenue with plug‑and‑play recovery flows, timing templates, and copy frameworks for ecommerce brands.

More Abandoned Cart Email Marketing Resources for You

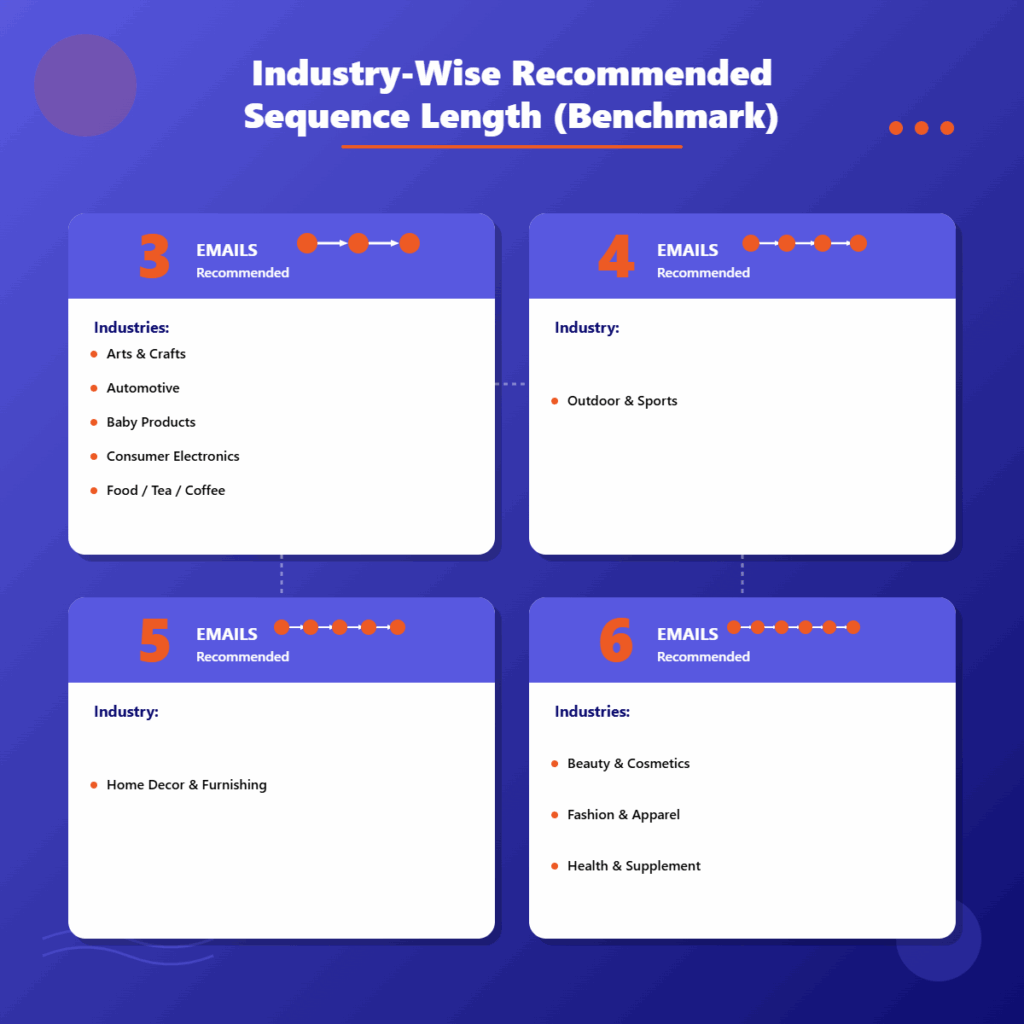

Industry-wise recommended sequence length (benchmark)

Sequence length should match decision complexity. Industries with quick, low-stakes decisions rarely need more than three touches.

Categories with higher consideration and more comparison shopping can justify longer sequences when inbox placement remains healthy.

For Arts and Crafts, Automotive, Baby Products, Consumer Electronics, and Food, Tea, and Coffee, a three-email sequence is the benchmark.

These categories tend to have fast purchase cycles and price transparency.

A timely reminder, an objection-handling follow-up, and a final nudge are sufficient when your products are not deeply researched.

Outdoor and Sports often benefit from four emails. Fit and feature questions add friction, so an extra message to address size guides, warranty details, or user stories can pay off.

Home Decor and Furnishing land at five emails. These carts are larger and more involved, with more stakeholders and space planning.

Extending your cart abandonment email sequence in this category helps answer questions that emerge over several days.

Beauty and Cosmetics, Fashion and Apparel, and Health and Supplement work best at six emails.

These are highly personal categories with strong preference, significant variety, and frequent comparison shopping.

Extending the sequence gives you room to move from reminder to education, then to proof and community, and finally to promotion or loyalty benefits without crowding any single message.

For other industries not listed above, assume three to four emails and adjust based on purchase cycle length and what you observe in your own deliverability and conversions.

Use the data that follows as guardrails, not rigid rules.

Follow-up spacing and abandoned cart email sequence timing

Follow-up spacing is the lever that balances urgency against fatigue.

Across the brands analyzed, the average delay between Email 1 and Email 2 is 18 hours.

From Email 2 to Email 3 the average spacing widens to 1.08 days.

From Email 3 to Email 4 the gap is 1.22 days, and from Email 4 to Email 5, the delay grows to 1.55 days.

Taken together, these intervals define reliable guardrails for your abandoned cart follow-up email timing and abandoned cart email resend timing.

Move quickly from the first to second touch to capture intent while it’s still warm, then gradually slow the cadence as you add context, proof, and urgency.

This tapering pattern reduces the feeling of being chased while allowing later messages to reframe value rather than simply repeating the same ask.

In practice, start with Email 1 within a few hours of abandonment, add Email 2 at approximately the 18-hour mark, and schedule Email 3 just over a day later.

For industries with sequences of four or more, continue to add roughly a day between each subsequent send until you reach your cap.

Best time to send abandoned cart email

Send-time optimization still matters, even in automated flows. The best time to send abandoned cart emails based on the data is the evening window between 6 PM and 9 PM local time, with a clear peak at 7 PM.

That window generally aligns with when shoppers are off work and more receptive to personal browsing, and when they have the headspace to make a purchase.

If you only change one thing this week, test shifting your cart reminders into the evening window in the recipient’s local time. You can maintain your original delay logic while re-anchoring delivery to this window.

For example, if 18 hours lands at 10 AM, hold the send until 6–9 PM where possible. The cumulative impact on opens and clicks is often significant.

More Abandoned Cart Email Marketing Resources for You

Deliverability reality: inbox placement declines with depth

Deliverability is where idealized seven-part cadences collide with reality. Inbox placement declines with each subsequent email in the flow.

In the first message, 46 landed in the primary inbox, 257 reached the promotions tab, and 138 were filtered to spam.

By the second message, only 28 reached the inbox, while 145 were promotional and 142 were spam.

The third message saw just 15 in the inbox, with 59 in promotions and 48 in spam.

By the fourth and fifth messages, inbox placement fell to single digits, with six and one, respectively, and spam grew as a share of total placement.

This pattern doesn’t mean you should never send a fourth or fifth email. It means you must earn the right to send those messages through strong engagement, early and careful sender hygiene.

Sustainable sequences prioritize quality over quantity. They get the core message across in the first two to three emails, reduce repetitive content in later emails, and avoid aggressive incentive escalation that can signal promotional intent to filters.

Use these findings to justify a shorter abandoned cart drip sequence in categories with quick decisions and only extend where your early emails keep engagement high.

When to introduce offers without training discount-seeking behavior

Most brands introduce discounts early. In this dataset, 90.67% of brands place an offer in Email 1.

Only 7.56 percent hold the first incentive until Email 2. A very small number wait until Email 3 at 1.33 percent, and nearly none wait until Email 4 at 0.44 percent.

There’s a clear tension between immediate conversion lift and long-term margin health.

Early offers work, but they can also train a segment of your audience to abandon to get a coupon. Consider segmenting first-time purchasers from loyal customers and testing the placement of incentives accordingly.

A sensible baseline is to keep Email 1 offer-free and lean on reminder, value props, and social proof.

Use Email 2 to introduce a gentle incentive such as free shipping or a small percentage off, and reserve stronger offers for Email 3 or later, especially in industries with longer sequences.

Another way to avoid discount-only conditioning is to pair incentives with value-building elements, such as reviews, FAQs, and user-generated content.

If you use a loyalty credit rather than a coupon, you can also anchor the incentive in a broader rewards strategy rather than a one-off price cut.

CTA strategy progression across the cart abandonment email sequence

Calls to action should evolve across the sequence. The data shows that Email 1 includes 11.74 percent of CTAs, with Email 2 close behind at 11.04 percent.

Email 3 sees a lift to 15.00 percent, reflecting a tightening of focus and urgency. Email 4 drops to zero, likely due to deliverability and creative changes that attempt to re-engage with plain-text or softer styles. Email 5 returns to 11.11 percent, while Emails 6 and 7 again show zero.

The practical takeaway is that Email 3 is a crucial turning point. That’s the moment to clarify the offer, restate the core benefit, and present a single primary CTA that reduces decision friction.

If you plan to test an incentive, Email 3 is the most defensible place to make it explicit without teaching shoppers to wait for discounts in your very first message.

Later emails should avoid CTA overload and repetition. If you choose to continue beyond three emails in industries that warrant it, consider varying your approach with a concise plain-text note from the founder, a fit or shade guide, or a micro-survey to diagnose hesitation.

Keep a single, clear action rather than stacking multiple competing CTAs.

Abandoned Cart Email Playbook

Turn abandoned carts into revenue with plug‑and‑play recovery flows, timing templates, and copy frameworks for ecommerce brands.

Abandoned cart email flow examples you can use today

When resources are limited, start simple. A three-email baseline fits the vast majority of brands, given the average of 1.52 emails and the clear dominance of one to three message flows in the data.

In this baseline, schedule Email 1 within hours of abandonment and deliver it in the evening window of 6–9 PM local time.

Focus on a polite reminder, clear product visuals, a concise value proposition, and social proof through ratings or testimonials.

Avoid offering a discount in this first message unless you already segment based on lifecycle and have proven it does not erode margin over time.

Email 2 should arrive approximately 18 hours after the first. This message is for objection handling. Use FAQs to address shipping speed, returns, sizing, compatibility, or ingredients, depending on your category.

If you want to test incentives, introduce a gentle nudge here, such as free shipping or a small guaranteed gift.

Keep the tone helpful, not pushy, and ensure the CTA moves shoppers straight back to their prefilled cart.

Email 3 should follow about a day later. This is the place to sharpen your CTA and unify all above-the-fold elements around one action. If you elect to use a limited-time incentive, make it explicit here and time-bound to encourage a decision.

Once again, deliver in the evening window to maximize open probability. The creative should be clean and focused, with minimal navigation links and a frictionless path to checkout.

In industries where the sequence needs to scale, treat four through six emails as thematic pivots, not echoes of the same message.

In Outdoor and Sports, add a fourth message that personalizes fit advice or showcases a customer story tied to the abandoned product.

In Home Decor and Furnishing, add a fourth and fifth email that offer design tips or room inspiration, and address shipping and white-glove options.

In Beauty and Cosmetics, Fashion and Apparel, and Health and Supplement, a six-part flow can move from education to community to benefits to offer without crowding.

Use Email 4 to provide a plain-text note or a quick quiz to resolve hesitation, Email 5 to present a loyalty or rewards angle, and Email 6 to bring urgency without resorting to repeated discounts.

As you build, anchor every send in the abandoned cart email sequence timing detailed above, use the evening window as your default for delivery, and monitor inbox placement closely.

The right cadence is the one that balances revenue with reputation.

Conclusion

Winning more carts is less about adding more messages and more about matching sequence length, timing, and incentives to your category and customer.

Use one to three emails as your baseline, expand thoughtfully only where your industry and engagement support it, and prioritize the 6–9 PM window for delivery with particular attention to 7 PM.

Keep an eye on inbox placement as your North Star, because later emails in a flow see sharply diminished deliverability.

If you want a simpler way to execute and iterate, TargetBay brings Email and SMS together with an AI Email Agent to help build flows fast, plus TargetBay Reviews to power social proof and Rewards to offer loyalty credits instead of coupons. Unified tooling lets small teams launch smarter abandoned cart email flows and refine them with less guesswork.

Transparency & Disclaimer

This guide is based on an analysis of 756 abandoned cart emails from 497 e-commerce brands, collected between 1 August 2024 and 5 June 2025 through InboxEagle.com, a platform that tracks public e-commerce email campaigns.

Important context for interpretation: Reported percentages and averages represent trends within this dataset, not universal benchmarks. Results can vary by industry, audience, region, and email platform. Metrics such as inbox placement, opens, and clicks are also influenced by list quality, deliverability, and recipient behavior.

Disclaimer: All emails analyzed were sourced from third-party e-commerce brands. TargetBay has no affiliation with any brands in the dataset.

These insights are intended as directional guidance and benchmarking, not guaranteed outcomes. Brands should validate and adapt strategies based on their own performance data.